Control your house, control your life

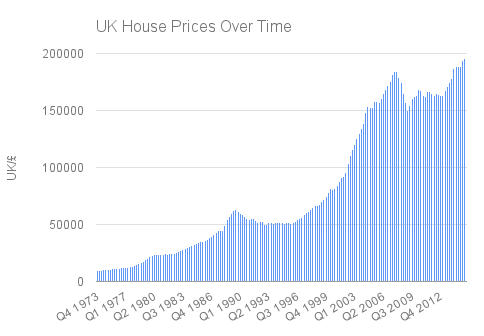

Ok, so our title is a bit of a bold statement. However with reports that house prices across the UK could rise by over a third before the end of this decade it might be time for you to evaluate your housing options.

First things first we know that it’s hard. An increasing housing shortage and rising prices has made buying an impossibility for many. In fact on recent evaluation of Cameron’s pledge to build 200,000 starter homes which will be sold at a 20% reduction on market price and available to first time buyers under 40, will still be unaffordable for two adults working full-time for the national living wage across most of southern England.

It’s a pretty bleak housing landscape especially for those as stated above trying to buy in southern parts of England, and let’s not even touch London which is unaffordable to the majority of the population let alone first time buyers. However, this article is for those lucky few who are in the position to get a mortgage and the benefits of doing so.

Why do I need a mortgage?

1. Investment

This is probably the first advantage people think of when it comes to owning your home. The truth is no one buys a property with the expectation that it will lose them money. Everyone optimistically things they can make a tonne of money off the right property. This is never a definite, take the last recession where we saw people in negative equity with houses they couldn’t afford to live in or to sell, that’s the nightmare scenario right there. However, if you pick the right house, in the right area, the economy stays on your side and you have a little bit of luck you could stand to make thousands from your property when you come to sell it. If you’re buying a house to live in then our advice would be to pick a house you want to live in, making money will hopefully come after years of happily living in your home. Fingers crossed.

2. Stability

2. Stability

Owning your own home and keeping up your mortgage repayments gives you real stability. Your landlord can’t evict you. You get to choose how you decorate and the changes you make to your property. You also don’t have to live in fear that you will never get your security deposit back after your last party. It’s completely yours and you can do whatever you want with it.

3. Opportunity

If you own your home you have a few opportunities to make some extra cash. It’s important to look into your local laws / mortgage / insurance terms and conditions before you do this but that’s different for everyone so responsibilities on you. You can use sites like Air BnB to rent out a spare room, you can get a roommate or further still you can rent out your entire apartment and move back home. You own an asset that can make you money.

4. Planning

Having a mortgage can help you plan your outgoings much more precisely on a monthly and even yearly basis. It’s important to mention that if you aren’t on a fixed rate mortgage then prices can fluctuate depending on interest rates. However, if you have a fixed rate mortgage you will know exactly what you will pay for the extent of your fixed rate period. Renting is a different story, firstly your landlord can increase your rent in line with prices in your area, secondly your landlord might choose to sell the property you live in meaning you need to find somewhere else to live. If you have to move then not only do you have to pay to get all your stuff in your new house, you need to pay a new deposit and deal with a new rent rate.

5. Overall savings

Depending on the mortgage rate, your deposit size and the location you choose to buy paying for a mortgage can be cheaper than renting on a month to month basis. For example if you choose to buy an apartment in a city like Glasgow, according to current calculations, a two year fixed rate mortgage with a 10% deposit on a £155,000 flat could cost you £514 per month. Whereas rent in a similar flat could cost anywhere between £700-£850 per month. If you get the right deal on your mortgage you could pay significantly less on a monthly basis. Who wouldn’t want that?

6. Privacy

6. Privacy

If you don’t own your home yet then you have two realistic options, live at home or rent somewhere. Both of these options might offer a few issues around privacy. If you still live at home with parents or guardians then you’re a guest in someone else’s house and depending on how respectful they are of your boundaries you might be seriously lacking in the old privacy department. When you rent, depending on your roommates, privacy will be less of an issue, that is until your landlord pops round. Landlords have the right to visit a property they own either in an emergency for which they can gain immediate entry or for inspection which must be at a reasonable time and they have to give you 24hrs notice.

7. Achievement

Owning your own home and having a mortgage can give you a real sense of achievement. Maybe you’re the first in your family to own your home. Maybe everyone in your family owns a home and it’s expected of you, whatever it may be signing that paperwork and, surprisingly, making those payments can make you feel amazing.

Ready for the mortgage?

Sounds good doesn’t it? If you can and you want to then go buy a house. It’s worth mentioning that home ownership just isn’t for everyone, and that’s ok by us.

Countries like Germany buck the ownership trend in fact, only around 43% own their home and as a country they have a low rate of unemployment. Counter this to Spain where around 80% of people own their homes but they have an unemployment rate of 27% partly as a result of the housing bubble bursting. We aren’t economists but the point we are trying to make is that renting is fine. You have more freedom, you don’t have to deal with expensive property repairs or crashing economies.

Let’s figure out how you go about getting one of those mortgages then

First things first figure out what you can borrow then forget this number and figure out how much you can afford to borrow. How much you can borrow is based off of your income, and if you’re buying with someone else a proportion of their income. To figure out how much you can afford to borrow work out monthly repayment figures that you can pay with relative ease on a monthly basis.

Get together as large a deposit as you can. This is the time to empty saving accounts, work the overtime and be at the mercy of family. The more you can pay upfront the lower you monthly costs will be.

So now you have your deposit and you know how much you can afford you can pick your house and apply for the mortgage. The biggest advice we could give would be to consider all options. Look on every comparison site and be ruthless. We have spoke to countless young people who got their mortgage through the bank they already bank with. They presumed this was easier and for the simple fact they already know who you are it probably is, but don’t do this by default. Look far and wide consider all options banks or building societies find the best for you.

Do your research and find out what all the terms mean this will make your life so much easier when it comes to completing the mortgage process. It’s important to understand fixed rate and arrangement fees check out this mortgage jargon buster glossary for help.

Happy mortgaging.